Make Your Advice Practice Leaner & Your Clients Happier.

Designed for the new era of financial services simplicity, our solutions help you harness the power of automation and compliance. They boost operational efficiency and make your dealings with clients more personalized and profitable.

All our solutions can be delivered in an ‘as a service’ model or ready for you to run on-premises or cloud. They connect compatibly with existing infrastructure and assist front and back office staff, as well as clients, in a comprehensive, user-friendly way, helping your business run smoother.

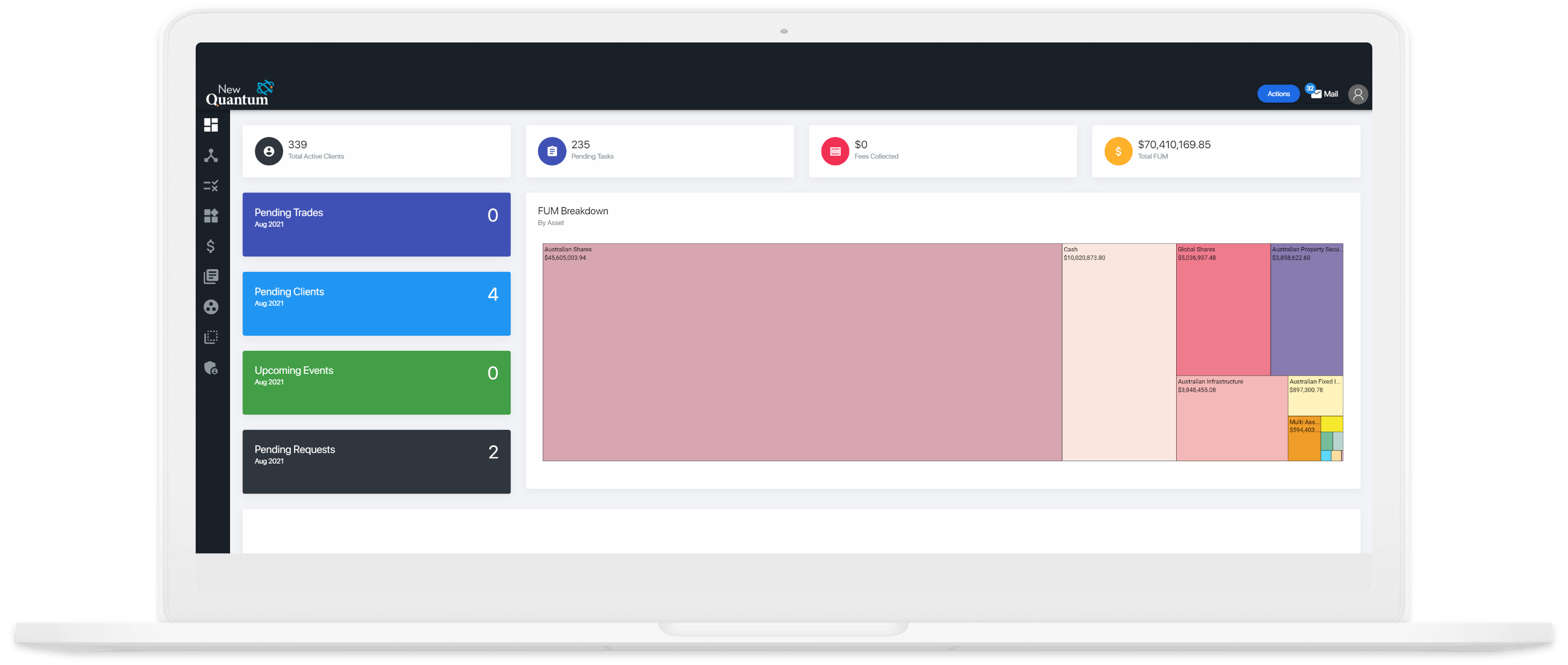

NQ CRM is a Customer Relationship SaaS application which incorporates a Practice Compliance Solution (PCS). NQ CRM has been purpose built for financial planners. It has five core modules which can be bought separately or bundled together.

- Core

- Practice

- Compliance

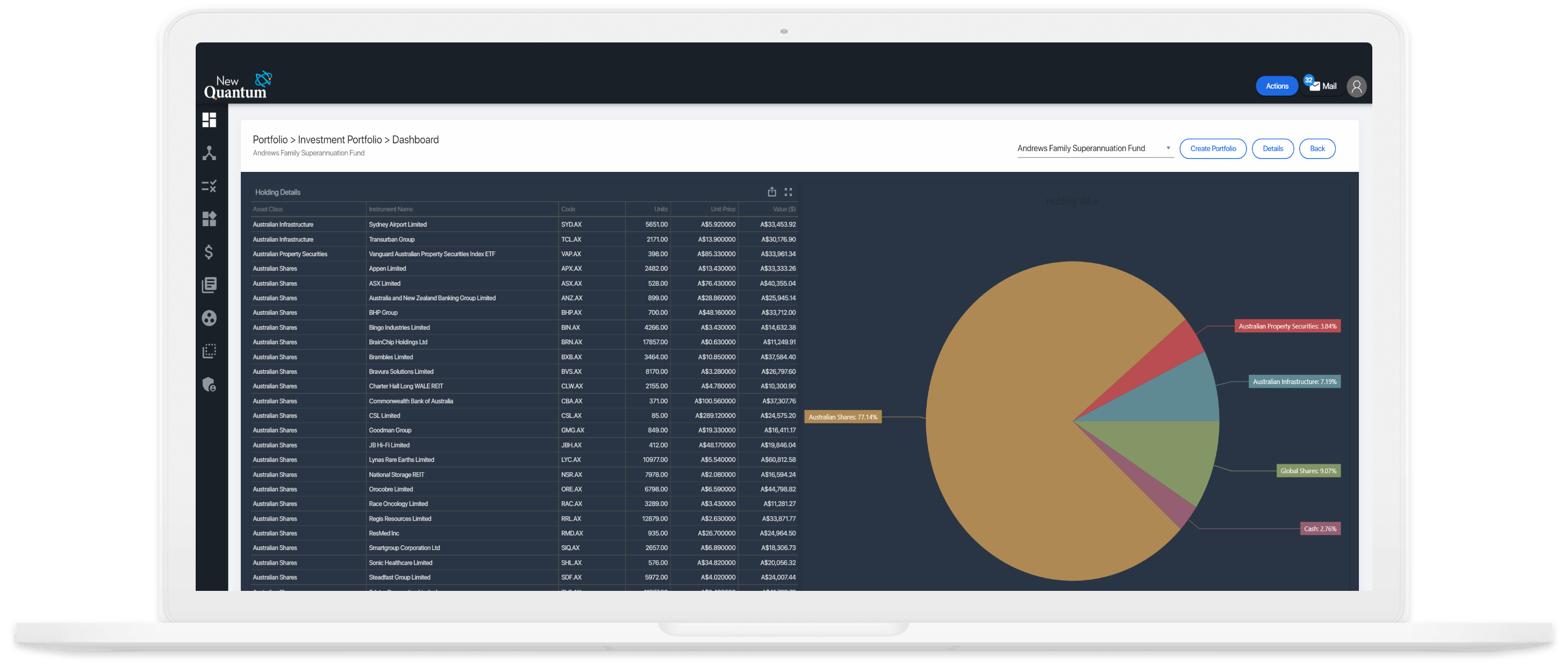

- Portfolio

- Revenue

NQ CRM is integrated with the NQ investment products outlined below which ensures financial advice can be implemented via straight through processing.

Coming Soon

NQ Direct is our managed account offering for advisers and their clients who wish to hold their assets directly in a broker and bank account. Our technology can automate trades and report client holdings daily.

NQ Direct has integrations with Morrison Securities, Open Markets, Macquarie Bank and DDH Graham.

NQ Direct can also provide an MDA service where there is an adviser providing personal advice to a retail client.

NQ Super is a retail superannuation platform designed to deliver flexibility without the administration burden, enabling you to take control of your super without the hassle.

NQ Super operates as a sub-plan of AMG Super (Acclaim Wealth). Click here to discover more.

NQ Pension is a retail superannuation platform for members moving to the pension phase. NQ Pension has several pension accounts available:

- Account Based Pension

- Transition to Retirement

- Term Allocated Pension

NQ Pension operates as a sub-plan of AMG Super. Click here to discover more.

Coming Soon

NQ Invest is our regulated investment platform product operated through an IDPS-like legal structure. Accounts can be established for the following legal entities:

- Individuals & Joint accounts

- Self-Managed Super Funds (SMSF)

- Corporations

- Unit Trusts

- Partnerships

NQ VMA offers a Virtual Managed Account service, enabling advisers to deploy sophisticated investment strategies with ease. Automated trade executions and in-depth reporting streamline the investment process, freeing advisers to focus on strategic planning and client relationships.

This service integrates seamlessly with Morrison Securities and ANZ Bank, ensuring effective and comprehensive investment management. It also encompasses a Managed Discretionary Account (MDA) service, ideal for advisers managing tailored investments for retail clients with distinct needs.